GreenHouse Agency implemented our MeridianLink and HubSpot integration utilizing Operations Hub Enterprise for Wellby Financial, enabling them to recover more than $181,000 in abandoned deposits and $598,000 in abandoned loans in the first 90 days.

By leveraging advanced tracking and automation tools, we streamlined their loan application process, significantly reducing abandonment rates and optimizing applicant follow-up strategies.

Challenge: Lacking Detailed Tracking for MeridianLink Applications

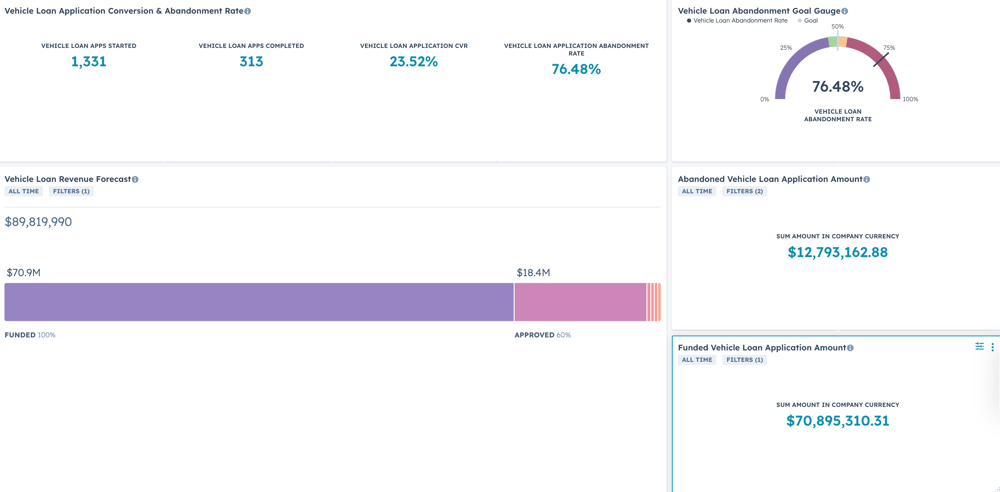

A common problem credit unions experience across the board is high abandonment rates on online loan applications. Typically, we see 70 - 80% of applicants who start an online application never finish. In order to drive more loan applications to completion, credit unions require visibility into applicant behavior and marketing and sales tools that allow them to effectively follow up. Our client, Wellby Financial, was looking for a way to gain these insights in an effort to understand and optimize the application journey.

MeridianLink online application for a vehicle loan.

MeridianLink is a loan origination system many credit unions use for the online application process – though it doesn't provide page-level metrics or follow-up tools to recapture applicant interest. To begin tracking MeridianLink data, we first installed GTM on MeridianLink applications to pull page views into HubSpot. We also added a HubSpot form before the MeridianLink application so they could capture lead information and track deal pipeline stages that match the MeridianLink application pages.

HubSpot custom analytics views for MeridianLink online applications.

|

|

HubSpot pre-application forms to capture contact details.

While the credit union was able to obtain a certain level of data and follow-up through both Sales and Marketing Hub using the above configuration, we wanted to craft a solution that would provide a more comprehensive view of the MeridianLink performance. We also wanted an alternative to using a lead form before the applications, as we found this added step can lower conversion rates of visitors to completed applications.

To accomplish this, we utilized the power of Operations Hub Enterprise.

Contact Tracking |

|||

Page View Tracking |

No | Yes | |

| No | No visibility into application completion rates or contact activities. | Provides visibility into contact activities, but only a view of the first page of MeridianLink application. | |

| Yes | Provides visibility into all stages of MeridianLink application, but contact activities are not guaranteed. | Provides visibility into all stages of the MeridianLink application as well as the contact activities associated with pageviews. | |

Solution: Leveraging HubSpot’s API for Application Tracking

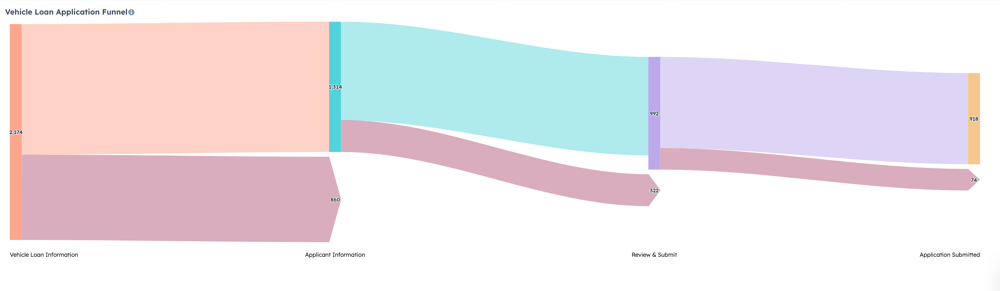

Instead of limiting Wellby to contact and page view tracking to collect their information, we wanted to implement field-level application tracking, too. This lets us go beyond the stages of the application that individual contacts viewed and see the specific fields that they completed, allowing Wellby to implement more powerful automation and reporting.

In order to have MeridianLink application information received into HubSpot, we created an initial workflow triggered off of the creation of a custom event. This would let us know if a deal already exists. Custom Code Actions in Operations Hub Enterprise then allow the deal to be either created or updated. This is similar to what the lead form accomplished, but much more powerful.

List of HubSpot workflows built to create this solution. |

Example workflow with custom code actions. |

|

|

Detailed view of data formatting and custom code actions in one of the HubSpot workflows.

With this level of application tracking, Wellby can see the application type, how much money was requested, employment states, homeowner status, and more to help assess applicants and follow up accordingly. The team can understand how effective their sales and marketing efforts are, and tie applications to specific activities.

|

|

|

Applicant details syncing from MeridianLink to HubSpot Deal record.

In the case that a contact does not complete an application within the client-configured time period, they would fall into a nurture workflow and receive relevant email follow-ups. If the application remains incomplete, they’ll continue to the abandoned application workflow, moving the deal to the closed lost stage and keeping the pipeline clean.

Abandoned application workflow containing a series of nurturing emails.

Additionally, each application workflow was created with branching logic, designed to handle multiple loan types and simplify management. If desired, our client could easily create a clone of a specific loan application workflow to customize the actions further.

Results: Increased Visibility for Deeper Analysis

With Operations Hub data sets, our client has access to more granular and customizable reporting capabilities. Custom calculations allow Wellby to see year-to-date and monthly comparisons, which lets them account for seasonal changes in loan applications. These data sets simplify the process of pulling these same calculations for multiple visualizations, which reduces manual effort.

Example Vehicle Loan Dashboard

With field-level data, Wellby can track abandonment rates on each application and more easily take action to regain applicant interest. For abandoned applications, we implemented a marketing campaign to follow up with applicants through an automated email series.

This campaign generated $86,930.49 in attributed revenue by recovering abandoned deposit and loan applications, representing more than $779,000 in associated value. These results were achieved through 35 closed-won deals attributed to the campaign since its launch in September 2024.

Application Abandon Campaign

Abandoned application email nurture series campaign performance.

Abandoned application email nurture series campaign performance.

Tracking these campaigns provides Wellby with a clear idea of how their marketing and sales activities are performing with applicants, and allows for continuous optimization. We can see that the first email in their abandoned application campaign has an open rate above 50% and a click-through rate more than 46%, showing how highly engaged these applicants still are.

Follow-up Email #1

|

|

|

Impact: Recovered Approximately $1M in Abandoned Deposits & Loans in 90 Days

With this application tracking method utilizing Operations Hub Enterprise in place for Wellby, their marketing and sales teams always have the most up-to-date application information at their fingertips. This allows team members to better attribute web activities to specific contacts and applications, providing valuable insights into where users may have dropped off in the process.

Enhanced reporting and data on abandoned applications open up more opportunities for optimizing the digital journey. In just the first 90 days, Wellby recovered approximately $1M in abandoned deposits and loans, including $181,000 in deposit accounts. This demonstrates the significant impact of streamlined tracking and automation on recapturing potential revenue.

By eliminating lead forms, Wellby maintains data accuracy while enhancing the user experience. This streamlined process removes an extra step for users, increasing the likelihood that applicants will complete their loan applications. This approach not only simplifies the user journey but also boosts conversion rates, ultimately benefiting both applicants and Wellby.

December 20, 2024