For today’s credit unions, an omnichannel strategy is a competitive necessity. In this context, “omnichannel” means delivering a unified member experience across every touchpoint, digital, mobile, phone, and in-branch, so interactions feel continuous and connected no matter where they begin. This represents a step beyond the older “multichannel” model, where channels existed side by side but often operated in silos. Member expectations are rising quickly as digital-first banking, fintech innovation, and evolving payment technologies redefine what “good” looks like across the financial services industry. Members now expect every interaction with their financial institution to feel seamless, consistent, and connected, whether they’re tapping a digital wallet, applying for a credit card, or stepping into a branch for guidance on a major financial milestone.

Credit unions have long held a reputation for relationship-driven service, but relationship expectations are changing. Members want human-centered service with digital-level speed. They want proactive insights, not reactive support. And they’re comparing their member experience not just to other credit unions, but to leading banks, fintechs, and the digital retailers that set the standard for convenience.

The stakes are high: stronger loyalty, sustainable growth, and operational efficiency all hinge on how well credit unions can deliver seamless omnichannel experiences. With competition tightening and younger generations looking for always-on access, financial marketers must understand what’s next.

Below are the three omnichannel trends shaping the future of credit unions in 2026 and beyond, and why institutions can’t afford to miss them.

What Do Today’s Members Expect from a Truly Omnichannel Credit Union Experience?

Members increasingly expect:

- The ability to start a task on one channel and finish it on another.

- A consistent service tone, experience quality, and account holder context across all touchpoints.

- Real-time access to data, updates, and payment activity.

- A blend of digital convenience and personalized, human guidance.

Digital-first banking has reshaped expectations across every channel, including the branch. Members no longer evaluate credit unions solely on friendliness; they expect seamless, secure, instant access to information and services whenever they need them.

Trend 1: Seamless Digital + Human Integration Across All Member Touchpoints

Credit unions are moving from a multichannel model, where channels operate separately, to a true omnichannel ecosystem where digital and human interactions work together. This shift is a core driver of member experience and long-term loyalty.

How can credit unions integrate digital and branch experiences without losing the human touch?

The goal isn’t to replicate branch service online, but to create a connected ecosystem where members feel known, supported, and understood, no matter where they engage.

What role does consistency play in building trust?

Consistency is the backbone of trust in modern financial services. When a member receives conflicting information from a branch employee and a mobile app, confidence erodes. When the experience is unified, trust increases, and with trust comes deeper relationships and cross-product engagement.

What does a connected service model look like for both digital-native and branch-focused members?

A connected model ensures:

- Branch staff can see recent digital interactions, such as loan applications or card disputes.

- Call-center teams have access to the same data, notes, and context as front-line staff.

- Mobile and online banking echo the same messages, service options, and brand voice found in-person.

- Members can book appointments, upload documents, or receive follow-up support in whatever channel works best for them.

Key Forces Driving This Trend

- The convergence of digital banking, branch interactions, and call center support.

Credit unions are consolidating platforms and data sources so every channel “talks” to each other. - The rise of “branch-light” and appointment-first models.

Branches are becoming advice centers, helping members with complex needs while everyday transactions shift to digital channels. - Training staff to use shared data and tools.

Unified systems only create value when employees know how to interpret and apply member information to elevate the service experience. - Balancing automation with high-touch service.

Automation handles simple tasks (balance inquiries, payment alerts, card management), freeing staff to focus on relationship-building.

When done well, omnichannel integration strengthens loyalty, drives digital adoption, and supports sustainable growth.

Trend 2: Data + AI Powering Personalized, Predictive Member Journeys

Data is the new foundation of member experience, and AI is the engine that turns that data into action. In 2026, AI and analytics aren’t “nice to have”; they’re essential for credit unions aiming to compete with banks and fintechs.

Which technologies are enabling seamless omnichannel journeys?

Modern CRM platforms, integrated core banking systems, AI chat, predictive analytics, and marketing automation tools are now the pillars of connected financial institution ecosystems.

How does AI help credit unions deliver personalized, predictive experiences?

AI gives institutions the ability to anticipate needs and respond instantly. It can:

- Recommend credit card upgrades based on spending.

- Notify members when savings behaviors shift.

- Predict when a member may need loan support.

- Send financial literacy resources aligned to life stages.

- Identify friction points before members report them.

How can better data integration empower staff?

When all departments, from marketing to the call center, share a single, unified view of the member, the entire service experience becomes stronger and more connected. Staff can hold more informed, context-rich conversations because they understand each member’s recent interactions, preferences, and needs. Follow-up across channels becomes seamless, eliminating the gaps that often force members to repeat information or restart a request.

This level of continuity helps members feel recognized and valued rather than shuffled between departments. At the same time, staff work more efficiently, resolving issues faster and delivering support with greater confidence, ultimately boosting both internal productivity and overall member satisfaction.

Key Forces Driving This Trend

- AI-driven personalization across credit cards, loans, and everyday decision-making.

Financial marketers can create smarter segmentation, targeted messages, and dynamic campaigns aligned with real-time member behavior. - Unified member data reduces friction.

Account holder interactions across mobile apps, desktop banking, branches, and phone support all live in one place. - Predictive insights power proactive service.

Instead of reacting to issues, credit unions can prevent them, strengthening trust and reducing churn. - Operational efficiency through automation.

AI reduces repetitive work, enabling staff to focus on complex member needs while digital channels handle routine tasks.

Data and AI are redefining the future of financial services. The credit unions that embrace this shift will deliver better experiences at scale and gain a measurable competitive advantage.

Trend 3: Omnichannel Payments & Real-Time Expectations Redefining Speed

Payments have become a defining battleground for member loyalty. The demand for instant payments and frictionless transfer experiences has reshaped what members consider “basic functionality.”

How are fintechs raising the bar?

Fintechs offer real-time transfers, integrated digital wallets, and instant account updates, raising expectations for speed and transparency. Credit unions must match this pace to remain competitive.

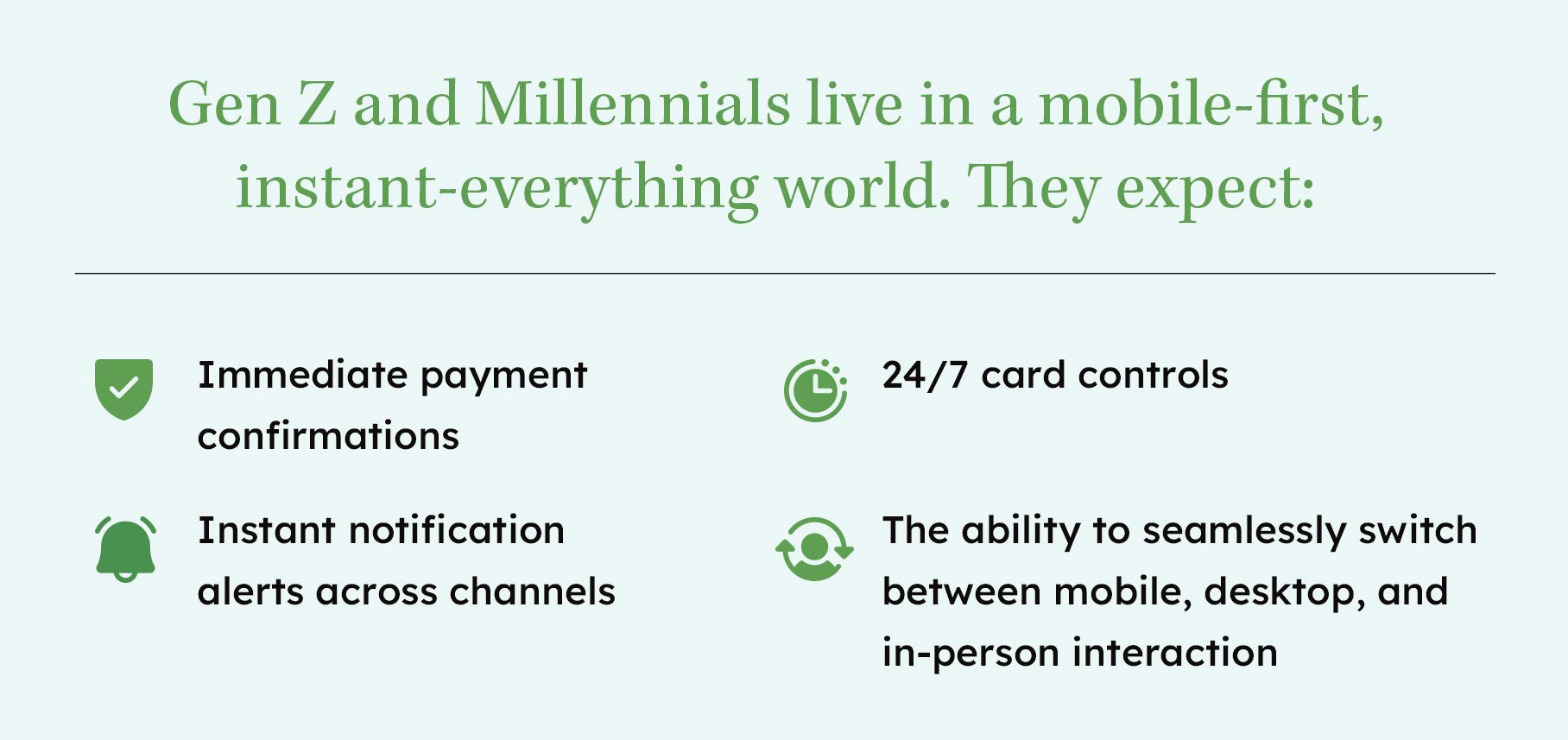

How can credit unions meet younger members’ expectations for always-on access?

Which gaps present the greatest risk?

Any delay in payment posting, card activations, or alert syncing creates friction—and in many cases, drives members to digital-only competitors.

Key Forces Driving This Trend

- Instant payments, digital wallets, and real-time transfers are becoming table stakes.

Credit unions that modernize payment infrastructure position themselves as future-ready. - Payment experiences influence trust.

Members judge reliability based on speed, transparency, and control. - Cross-channel payment updates must be synced.

A change made in the mobile app should be visible in the call center and branch systems immediately. - Competition from banks and fintechs is intensifying.

The institutions offering the fastest payment journeys are winning engagement.

Measuring Omnichannel Success

Credit unions need clear KPIs to know whether their strategy is working.

Strong performance across these KPIs signals an omnichannel strategy that enhances trust, improves efficiency, and drives long-term value.

The risk of not modernizing? Loss of member trust, reduced competitiveness, and missed opportunities for engagement and revenue.

The Future of Omnichannel Belongs to Member-First Credit Unions

Omnichannel is no longer optional. It is the foundation for sustainable growth, stronger relationships, and modern financial services excellence. The credit unions that win the future will be those that blend digital convenience with human-centered service, delivering intelligent, connected, real-time experiences across every member touchpoint.

Now is the moment for credit unions to invest in the platforms, data, and strategies that create frictionless journeys. The payoff is clear: deeper loyalty, stronger engagement, and long-term member relationships that set institutions apart for years to come. GreenHouse Agency is a catalyst to drive your credit union through trends and whatever else comes next. Connect with us to learn more about how we thrive in innovation.

December 17, 2025